Student Tax Form Information for HOPE 1098T

Please note that Redlands Community College cannot give you tax advice regarding the 1098T form. Consult with your tax preparer for assistance in how to claim the 1098T tax credits.

Frequently Asked Questions

What is the 1098T Form?

The 1098T Form is a Federal IRS document that is provided to students who are eligible and have paid for qualified educational expenses in the most recent calendar year. Students who have adjustments during the most recent calendar year for the prior calendar year transactions will also receive a 1098T Form.

This tax form only includes applicable tuition and fee payments paid out of pocket, by a third party, or by financial aid. The 1098T tax form does not include: books, student housing, late fees, collection charges, and student conduct fines. International student or others who do not file U.S. taxes with the IRS are most likely not eligible for a 1098T tax form.

Am I eligible to receive a 1098T Form?

A 1098T form will not be issued for:

• Courses for which academic credit is not issued;

• International students.

A 1098T Form will not be mailed to students who:

• Have an address hold;

• Have institutionally-issued ID numbers (in the format beginning with 241-00-xxxx)

instead of Social Security numbers.

When will I receive my 1098T Form?

If you are eligible to receive a 1098T Form, it will be available online or mailed by January 31.

Will I receive a 1098T Form in the mail?

If you downloaded the 1098T form online from Self-Service, you will not receive a copy in the mail.

What should I do if my 1098T Form may have incorrect information?

After receiving or downloading your 1098T Form, please ensure that your Name, Address, Social Security/Taxpayer Identification Number and information in the boxes are correct. If any of that information is incorrect, please send an email with the correct information to the Redlands Community College Business Office (Business.Office@redlandscc.edu) from your Redlands student email account. The Business Office will notify you of their findings within 2-3 business days after review.

-

Steps to Consent to Electronic Delivery of Tax Information

Go to the Redlands Website

Near the top right of the Redlands webpage, click on the link for “Go Redlands”.

(Note: You can open this link in a new window to keep these instructions visible.)Log in to Go Redlands

Enter your Redlands username and password in the appropriate fields.

This is the same username and password you use to access your Redlands email.

If prompted, answer the security questions using the same answers you selected when you first set up your account.Access Self-Service

Once logged in, click on the Self-Service tile to proceed.

Select Tax Information

In Self-Service, click on the Tax Information widget to proceed.

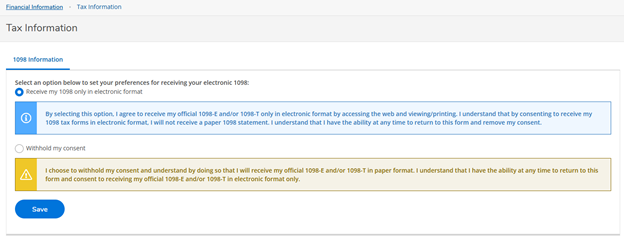

Consent to Electronic Delivery

To consent to electronic delivery of your 1098-T tax form, select the option for “Receive my 1098 only in electronic format” and then click the Save button to confirm your choice.

(See the example below.)

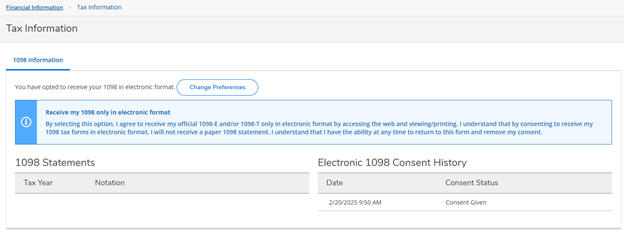

If you have already consented to electronic delivery in the past, there's no need to do it again. Your consent remains active until you revoke it.

You're Done!

To change your consent, simply click “Change Preferences”, then confirm your consent by ensuring the highlighted option is selected.